In our traditional ideology, there is no doubt that the financial industry is professional and quantifiable so it’s odd to mix with marketing promotion. Why marketing in the traditional finance market seems not essential

in the past is because just few products existing in the traditional fund industry and most products would be promoted by banks so it does not face fierce market competition. But there is an opposite situation that

over 7500 funds existing in the market and each fund contains its characteristics within different industries, which is an inter-industry competition and difficult to stand out among 7500 funds. Thus, an increasing

number of funds would be branding and promoted to retail investors and various overwhelming publicity are spreading out recently.

Details data in Fund Markrt >>

Why the fan culture will step into the fund market recently is because the homogenization exists in the fund market and each fund will imitate others including marketing strategy, branding methods, etc. There are over 137

funds that gained a great performance on their annualized rate of return so it’s difficult for investors to distinguish which fund performs better just according to its data. So people tend to seek help from fund managers

based on their various branding personalities. But we need to realize the accuracy of prediction from fund managers is not 100% and they cannot guarantee to achieve perfection every time so those who can be the top

25% of fund managers are fabulous enough and investors need to contain some knowledge related funds to distinguish what product can return greatly instead of believing online promotion blindly.

As Mr. Lai working in public offering funds mentioned that those fan communities online are just investors showing their admiration and loyalty to specific fund managers instead of representing the profession or credential

of fund managers. From the perspective of the fund industry, the public offering of fund managers has strict regulation on their personal branding so those existing accounts are generated by their fans because of the

credential and profession. Thus, the data and comments online are subjective and biased. But for the privately offering fund managers tend to promote on social media to build up branding and sell their product, which

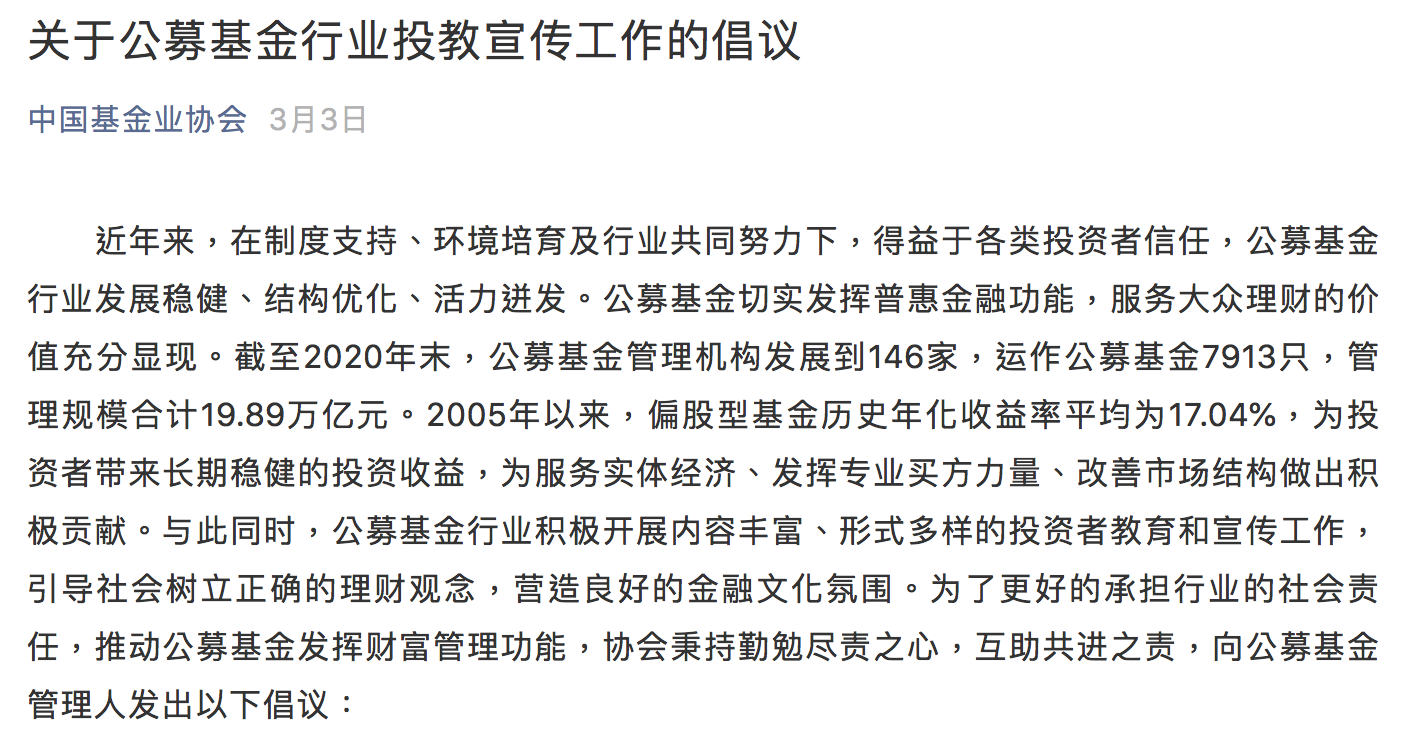

would be looser. Since branding is reasonable and beneficial nowadays and it can gather more social announcements, if the content is under financial regulation without misinformation, then fan culture toward fund managers

can be allowed.

But for the public investors, over 77% of people would partially believe fund managers because the majority of us are not professional enough to predict the fund markets and have no time to investigate the trend so fund

managers can assist them to do that. However, they are clear that fund managers are not the god to predict accurately every time so gaining financial knowledge is essential for investors to supervise their own investment.

As Ms. Chen working in LiDe fund company believed each industry needs to be marketing but it should be supervised by related institutions or the government. The core function of marketing is to help consumers find the products

they need. If over-marketing or even cheats consumers into buying products, it should be regulated because false marketing and misleading investment would not be allowed in the fund industry. If not, fan culture toward

fund managers can be accepted by the public because of their profession and credential in the fund market.